Everytime I play, I learn something new - how to analyze a deal, how the cash flows for every event that happens in your life, etc. I immediately played the game with my family and friends. So when I got back from my 6-month stint in the US, I didn’t hesitate to buy the game and bring it home with me to the Philippines. When I went to the US a year after, buying a Cashflow 101 board game for myself was one of my main goals.

It was a real learning experience, realizing that there’s a different world of money out there I’ve never recognized before. I enjoyed the game so much I played again (and paid another PhP 800). Even though the price is quite expensive (at that time) at PhP 800 for a 4-hr workshop, I grabbed the opportunity right away. One day, while reading through the Entreprenuer’s forum, I learned that someone is holding cashflow 101 games at AIM Makati City.

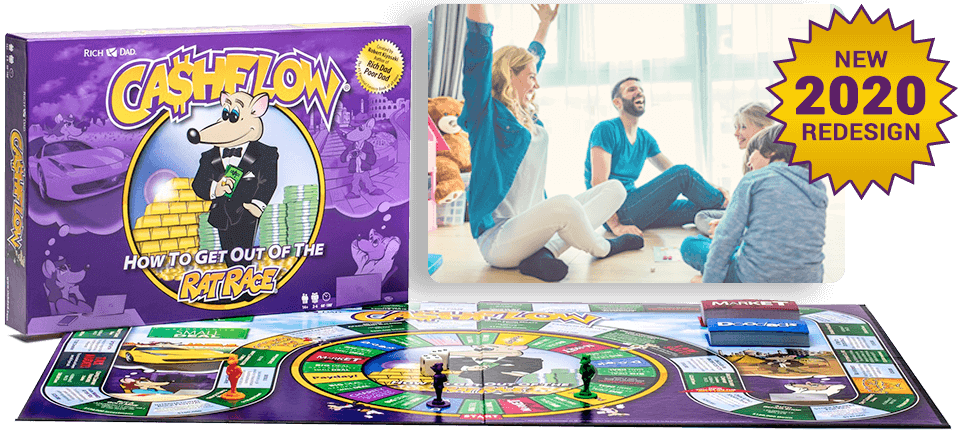

And being a struggling employee facing credit card debts, I didn’t have that amount of money then. The only problem - the boardgame costs quite a bit, around PhP 10,000. Ever since reading the book and finding out about the boardgame, I had a yearning to play Casflow 101. I first learned about the Cashflow 101 boardgame around 2005 when I read Rich Dad Poor Dad book of Robert Kiyosaki. Again this is true in real life.Īt the moment, interest rates are poor and ‘slow’ money in the bank is in reality losing value with inflation, so make it work for you by doing something with it.A couple of weeks ago, my wife and I played Cashflow 101 game board as a special bonus to the first 10 who bought my ebook guide Rich Money Habits – 8 Ways To Shift Your Money Habits and Be Rich. I was excited because I haven’t done anything like this before in my life. Remember that some are more worth paying off than others. The least you can do is to pay off some of your debts. If you have lots of money, do something with it. The next point is a biggie, but I see people ignoring it all the time. It may be worth just going round the Rat Race doing very little for a few goes to pay off your borrowed money from the bank to pay for that ‘Big Deal’. When buying Businesses or property, if they cost more to buy than you can afford, remember to factor in the increased Cashflow to see if it is worth doing. You may have an opportunity to sell the property at a profit if you or somebody else picks up a ‘Market’ card. Next, always buy property whenever you can with spare cash, even if the cashflow is poor or even negative. By then, you will have more money than you know what to do with! This extra money should enable you to buy ‘Big Deals’ and you will very quickly be able to get out of the ‘Rat Race’. If you pick this card, you should borrow money from the bank (without going bankrupt) and just wait for you or somebody else to pick up the relevant sale card. The $1 share buying card (the are in fact two of them) should be a gold mine as when you sell, you could get up to 40 times your money. You do this by buying as much shares as you possibly can, probably using most of your spare cash! You can’t do anything without it, so you need to leverage it as much as possible. Let’s start off with the concept of raising money. A few ideas to help you win the Cashflow 101 game.

0 kommentar(er)

0 kommentar(er)